Why CLO Equity?

OFS Credit Company believes that the capability to underwrite, analyze and value underlying loan portfolios of CLOs represents a significant competitive advantage, particularly when investing in the inefficient secondary market.

- Attractive Returns

- Attractive Risk Profile

- CLOs Benefit from Rising Interest Rates

- Quarterly Cash Flows

- Broad Diversification

- Deep Market

What are Leveraged Loans?

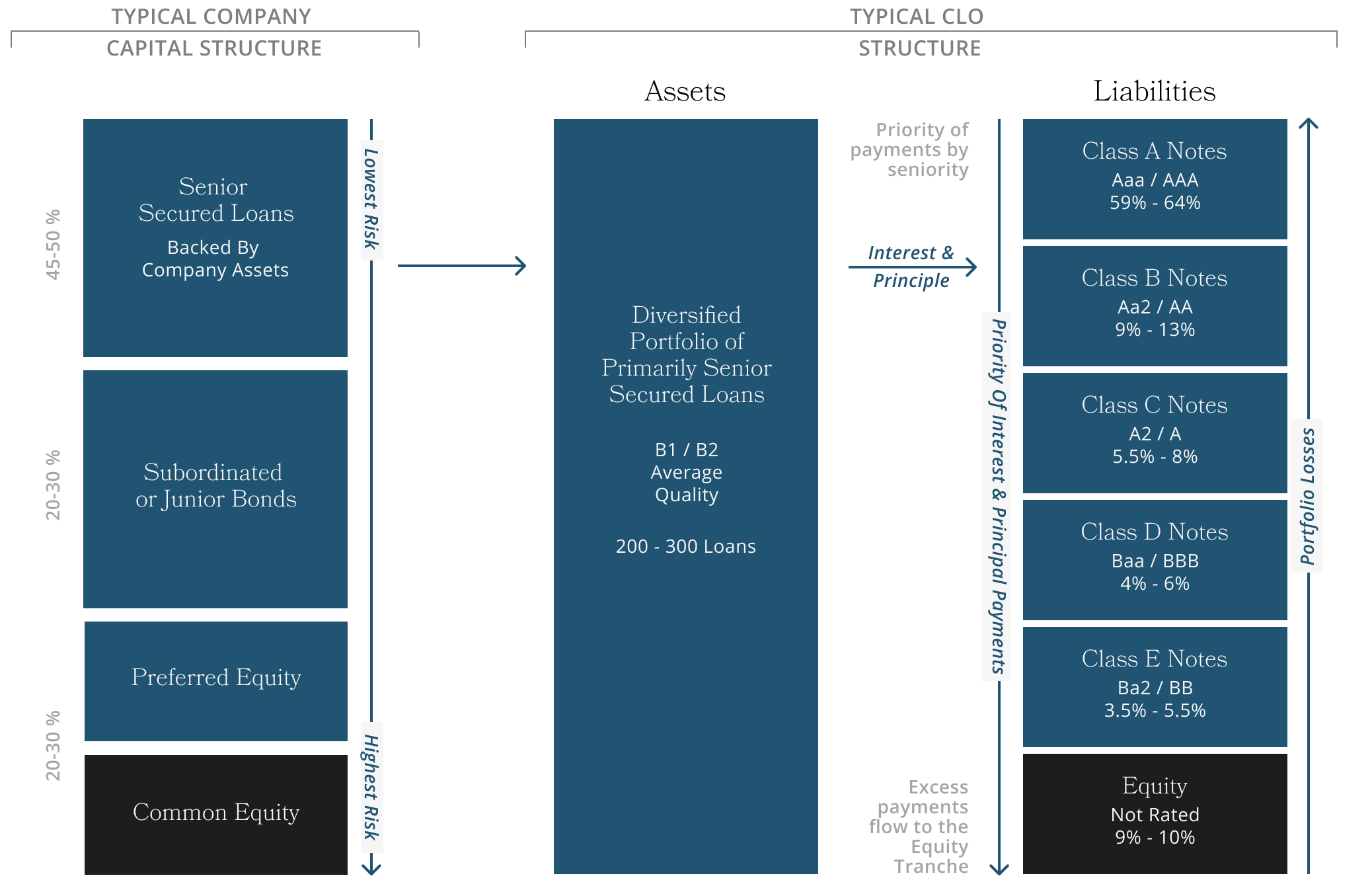

Leveraged loans are mostly senior secured loans extended to corporate borrowers to fund leveraged buyouts, recapitalizations, debt refinancing and other corporate purposes. These loans are typically originated and structured by commercial banks. Senior secured loans are ranked higher than subordinated bonds and equities in the capital structure for a company. Historically, senior secured loan recovery rates have been higher compared to other types of capital in the structure.

On average, these loans have a loan-to-value ratio of approximately 50% – 75% at the time of origination.

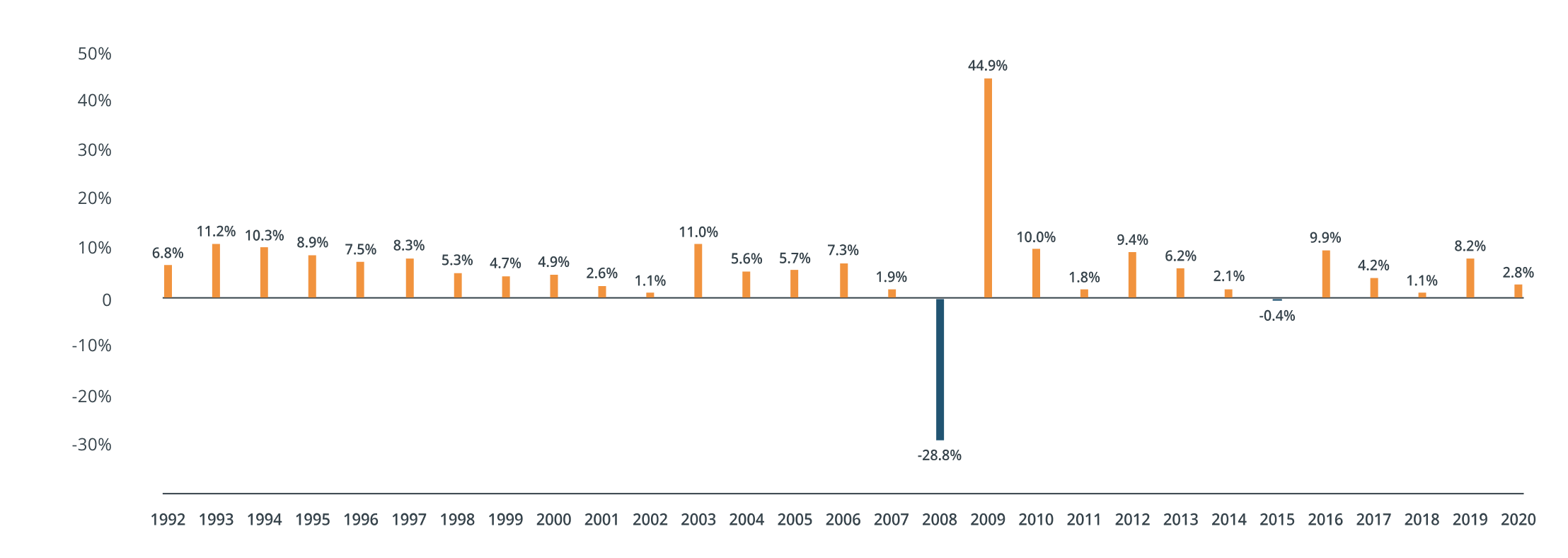

Credit Suisse Leveraged Loan Index – Annual Total Returns

Source: Credit Suisse. Past performance is not indicative of future results.

The Credit Suisse Leveraged Loan index tracks the investible universe of the US-denominated Leveraged Loan market. The index is not subject to any deductions for fees, expenses or taxes. You cannot invest directly in an index.

What is a Collateralized Loan Obligation (CLO)?

A CLO is a securitization vehicle that invests in primarily senior secured, floating-rate, first-lien leveraged loans. The vehicle is financed by floating-rate debt, issued with ratings from AAA through BB, and equity (CLO Equity). Cashflows generated from the pool of loans in the vehicle are distributed sequentially based on the priority of payment. CLO debt tranches provide structural leverage to allow the equity tranche to benefit from levered exposure to diversified leveraged loans. CLOs have covenants and tests that are built in to provide protections with the aim of mitigating risk. These tests include the overcollateralization test, interest coverage test, concentration limits, and more.

Source: LCD Global Review – US/Europe 2Q2018 and LCD Loan Primer “Syndicated Loans: The Market and the Mechanics - 2017”

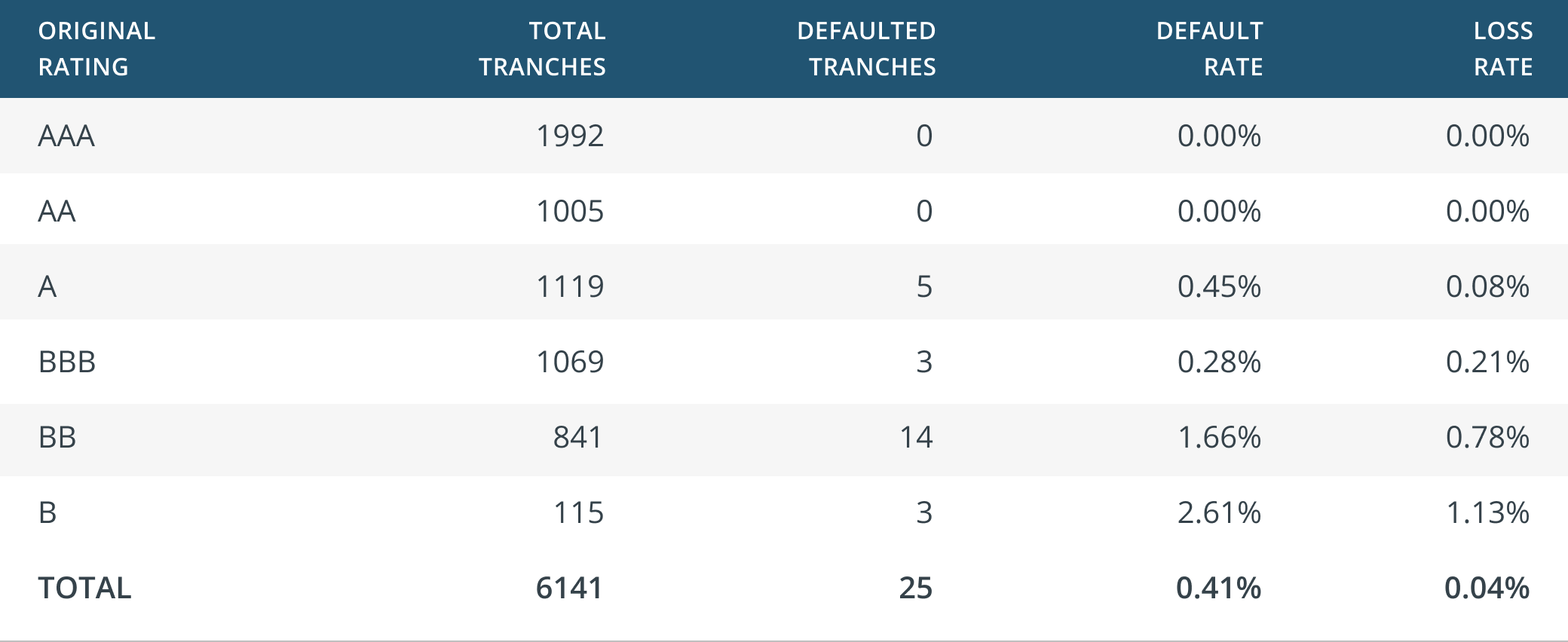

US CLO Historical Tranche Defaults from 1994 -2013

Source: Morgan Stanley Research, "A Primer on Collateralized Loan Obligations (CLOs)", published on February 3, 2017. Includes all US cash flow CLO tranches ever rated by S&P as of year-end 2013. Default rate equals the number of ratings that had ratings lowered to “D” divided by the total number of ratings. Loss Rate equals the sum of losses divided by the sum of issuance amounts. Based on market values from trustee reports used to estimate tranche losses when necessary. Tranches without available loss data are excluded.

While the data and information contained in this graph report have been obtained from a source that OFS Capital Management ("OFS") considers reliable, OFS has not independently verified all such data and does not represent or warrant that such data and information are accurate or complete, and thus they should not be relied upon as such. Past performance is not indicative of, or a guarantee of, future performance.